The LIC Jeevan Anand Plan (Plan No. 915) is one of Life Insurance Corporation's most popular endowment plans, combining the benefits

of life insurance coverage with a savings plan. It provides financial security to the policyholder's family in case of the policyholder’s

unfortunate demise during the policy term, along with a maturity benefit if the policyholder survives the policy term.

Additionally, the policy offers a whole life risk cover even after maturity. Here’s a detailed description:

- Savings + Protection: The plan provides financial protection during the policy term and a lump-sum payout on maturity, ensuring both short-term and long-term financial security.

- Lifetime Risk Coverage: Even after the maturity benefit is paid, the life cover continues for the policyholder's lifetime.

- Guaranteed Payouts: Maturity Benefit includes the Sum Assured on Maturity + Simple Reversionary Bonuses + Final Additional Bonus (if any). Death Benefit offers financial security to the nominee in case of premature demise.

- Bonus Accumulation:1. Eligible for Simple Reversionary Bonuses throughout the policy term. 2. May include Final Additional Bonus at maturity or on death, if declared by LIC.

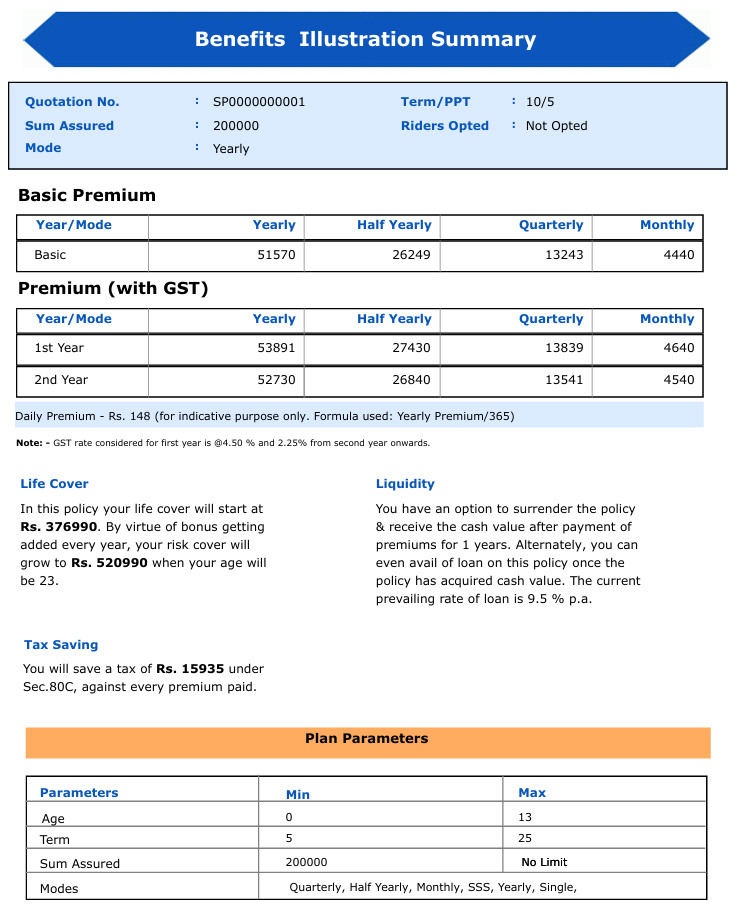

- Flexible Premium Payment: Premiums can be paid yearly, half-yearly, quarterly, or monthly (ECS/Salary Deduction).

- Loan Facility: After acquiring a Surrender Value, policyholders can avail of loans against the policy.

- Optional Riders:Riders like Accidental Death and Disability Benefit or Term Assurance Rider can be added for enhanced coverage.

- Tax Benefits: 1. Premium payments qualify for tax benefits under Section 80C of the Income Tax Act. 2. Maturity and death benefits are exempt under Section 10(10D).

- Benefits of LIC Jeevan Anand Plan 915:

- 125% of Basic Sum Assured

- 7 times the Annualized Premium

- Plus bonuses, if any.

- Minimum Death Benefit: 105% of all premiums paid (excluding taxes, extra premiums, and rider premiums).

- Maturity Benefit (After Policy Term)

- Sum Assured on Maturity (equal to Basic Sum Assured) + accrued bonuses.

-

- Lifetime Risk Cover:

- A unique feature where life cover continues even after maturity, offering financial protection to the family.

-

- Surrender Benefit:

- After payment of premiums for at least 2 consecutive years, the policy acquires a Surrender Value.

-

- Policy Revival:

- A lapsed policy can be revived within 5 years from the date of the first unpaid premium, subject to conditions.

-

- Policy Revival:

- 1. Lifetime Financial Protection: Ensures family security even after the policyholder's demise.

-

- 2. Savings-Oriented: Builds a corpus for future financial goals.

-

- 3. Flexibility: Offers multiple premium payment options and optional riders.

-

- 4. Legacy Planning: Lifetime cover helps in wealth transfer to the next generation.li>